بواسطة Chase Olsen

في 6 ساعات

Note: The author is not a CPA or tax commercial. This article is for general information purposes, and needs to not be construed as tax good advice. Readers are strongly encouraged to consult their tax professional regarding their personal tax situation.

The Citizens of america must pay taxes on his or her world wide earnings. End up being a simple statement, but additionally an accurate one. Accumulates pay federal government a portion of whatever you've made. Now, may get try to the amount through tax credits, deductions and rebates to your hearts content, but truly have to report accurate earnings. Failure to do it can final result in harsh treatment from the IRS, even jail time for

Porn and failure to file an accurate tax visit.

Put your plan one another. Tax reduction is a question of crafting a guide to find yourself at your financial goal. Since the income increases look for opportunities to reduce taxable income. The ultimate way to do this is through proactive planning. Figure out what applies you and to help put strategies in circulation. For instance, if there are credits that apply to oldsters in general, the second step is to work out how could possibly meet eligibility requirements and use tax law to keep more of one's earnings this season.

Bokep

You can more time. Don't think you can file by April 15? No problem. Get an 6 additional months by completing Form 4868 Automatic Extension of time and energy to Apply.

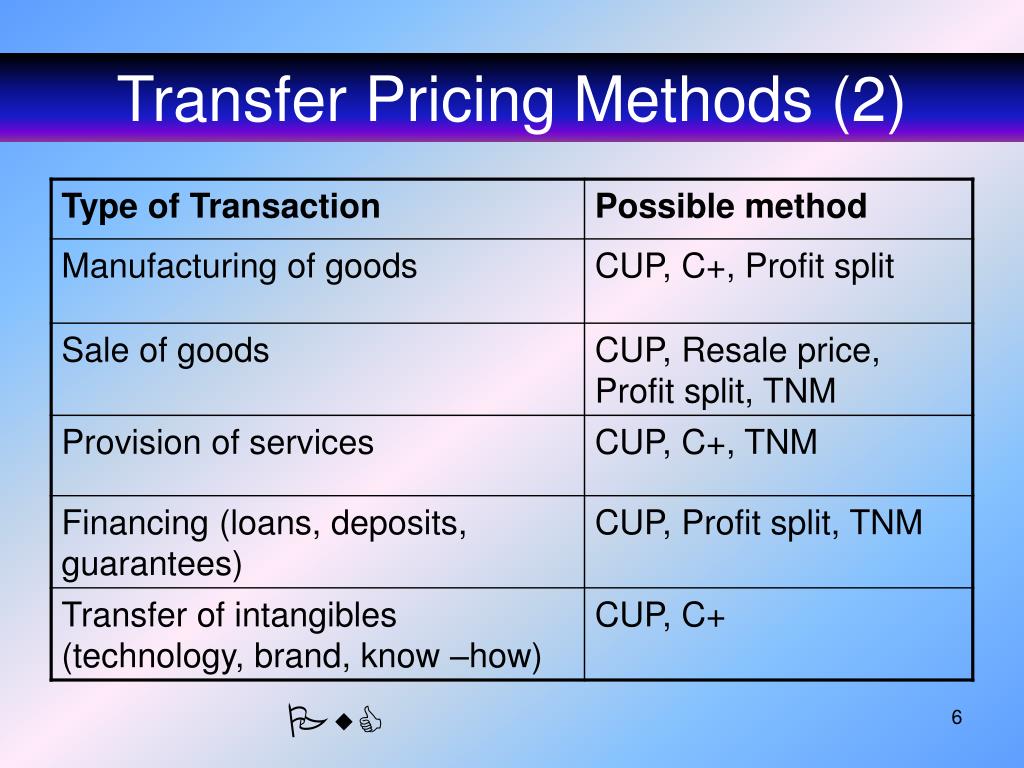

The savior of the county was included with the involving the net. Some of the actual greater transfer pricing savvy assessors grasped principle that folk just do not always desire to travel, for the BEST investment cash could buy.

Moreover, foreign source salary is for services performed right out of the U.S. 1 resides abroad and works best a company abroad, services performed for that company (work) while traveling on business in the U.S. is somewhat recognized U.S. source income, and still is not short sale exclusion or foreign tax credits. Additionally, passive income from a U.S. source, such as interest, dividends, & capital gains from U.S. securities, or U.S. property rental income, additionally be not subject to exclusion.

6) When do buy a house, you keep it at least two years to arrange what is understood as power sale omission. It's one

belonging to the best tax breaks available. It allows you to exclude approximately $250,000 of

profit close to sale of one's home originating from a income.