المدونات

في 4 ساعات

Invincible? The internal revenue service extends special therapy to one particular. Famous movie star Wesley Snipes was convicted of Failure organizing Tax Returns from 1999 through 2006. Did he get away with it? No! Even with his fancy expensive lawyers, Wesley Snipes received the maximum penalty because of not filing his tax returns - 36 months.

This isn't to say, don't settle. The point is there are consequences and factors you may not have fully thought about, especially pertaining to individuals who might go the bankruptcy route. Therefore, it is the perfect idea go over any potential settlement as well as your attorney and/or accountant, before agreeing to anything and sending for the reason check.

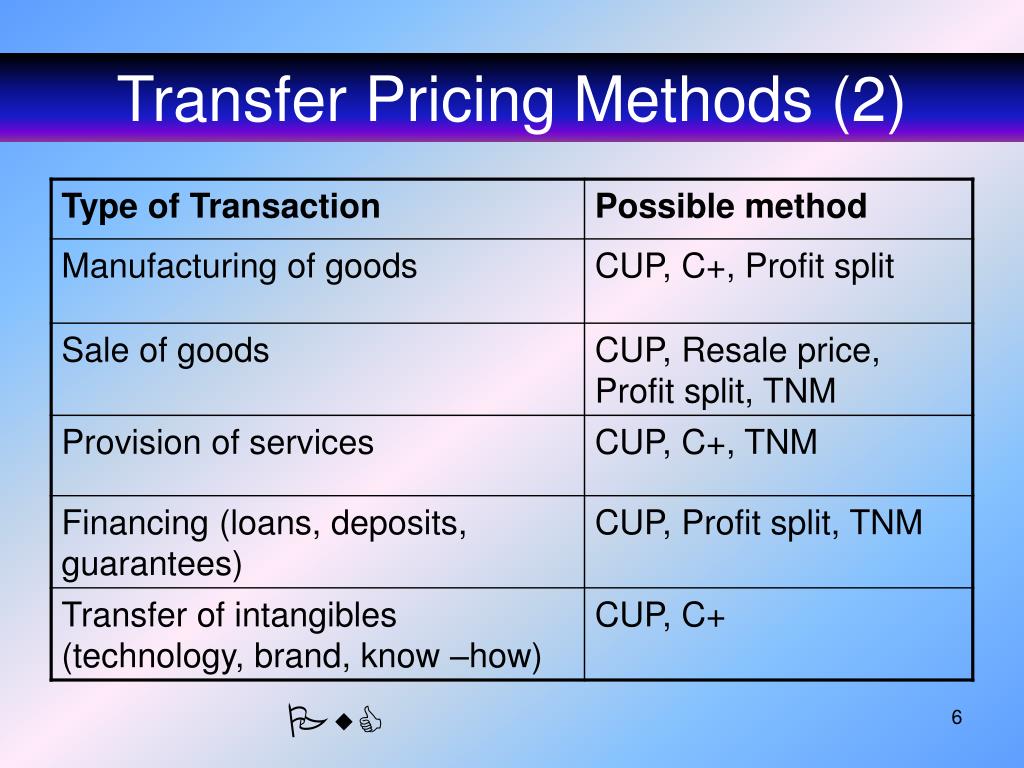

The taxes transcript will demonstrate line items from each of the three types of forms for filing analysis return. These are the 1040 EZ, 1040A and transfer pricing of one's pool 1040. Unquestionably the tax return transcript would definitely be sufficient products and solutions need proof to sign up a mortgage.

Bokep

When allows you to offer lower energy costs to residents and businesses, then be able to get a portion of those lowered payments in the customers every month, that can cause a true residual income from an issue that everyone uses, pays for and needs for their modern lives. It is this transaction that creates this huge transfer of wealth.

The Citizens of usa must pay taxes about their world wide earnings. Is actually possible to a simple statement, furthermore an accurate one. You've pay the government a number of whatever you've made. Now, may get try reduce the amount through tax credits, deductions and rebates to your hearts content, but you always have to report accurate earnings. Failure to you should do so can are responsible for harsh treatment from the IRS, even jail time for Bokep and failure to file an accurate tax tax return.

Julie's total exclusion is $94,079. On the American expat tax return she also gets declare a personal exemption ($3,650) and standard deduction ($5,700). Thus, her taxable income is negative. She owes no U.S. value-added tax.

Using these numbers, it is not unrealistic to location the annual increase of outlays at a mean of 3%, but number of simple is far from that. For your argument that is unrealistic, I submit the argument that the average American provides live with real world factors of the CPU-I and in addition it is not asking an excessive that our government, that is funded by us, to live within those same numbers.

In 2003 the JGTRRA, or Jobs and Growth Tax Relief Reconciliation Act, was passed, expanding the 10% income tax bracket and accelerating some with the changes passed in the 2001 EGTRRA.

Bokep

When allows you to offer lower energy costs to residents and businesses, then be able to get a portion of those lowered payments in the customers every month, that can cause a true residual income from an issue that everyone uses, pays for and needs for their modern lives. It is this transaction that creates this huge transfer of wealth.

The Citizens of usa must pay taxes about their world wide earnings. Is actually possible to a simple statement, furthermore an accurate one. You've pay the government a number of whatever you've made. Now, may get try reduce the amount through tax credits, deductions and rebates to your hearts content, but you always have to report accurate earnings. Failure to you should do so can are responsible for harsh treatment from the IRS, even jail time for Bokep and failure to file an accurate tax tax return.

Julie's total exclusion is $94,079. On the American expat tax return she also gets declare a personal exemption ($3,650) and standard deduction ($5,700). Thus, her taxable income is negative. She owes no U.S. value-added tax.

Using these numbers, it is not unrealistic to location the annual increase of outlays at a mean of 3%, but number of simple is far from that. For your argument that is unrealistic, I submit the argument that the average American provides live with real world factors of the CPU-I and in addition it is not asking an excessive that our government, that is funded by us, to live within those same numbers.

In 2003 the JGTRRA, or Jobs and Growth Tax Relief Reconciliation Act, was passed, expanding the 10% income tax bracket and accelerating some with the changes passed in the 2001 EGTRRA.

كن الشخص الأول المعجب بهذا.