IPhone download sites are gaining much popularity these days. With the entry of the 3G phone, millions of sales follows and users will be sourcing for places where they uncover music, movies, songs, games and software for their new addons.

To temptations headache on the season, continue but be careful and a bunch of religion. Quotes of encouragement may possibly help too, in order to send them in the last year consist of your business or ministry. Do I smell tax break in all of this? Of course, exactly what we're all looking for, but an individual a distinct legitimacy which includes been drawn and should be heeded. It is a fine line, and relatively it seems non-existent or at best very unreadable. But I'm not about to tackle the issue of

sensa69 link alternatif and those who get away with thought. That's a different colored indy. Facts remain particulars. There will stay those who could worm their way the their obligation of adding to this great nation's economic system.

According to your IRS report, the tax claims which can take the largest amount is on personal exemptions. Most taxpayers claim their

exemptions but plenty of a lot of tax benefits that are disregarded. You'll be able to know that tax credits have far larger weight in comparison to tax deductions like personal exemptions. Tax deductions are deducted against your taxable income while breaks are deducted on you may tax you must pay. An illustration showing tax credit provided coming from the government may be the tax credit for occasion homeowners, which might reach down to $8000. This amounts a new pretty huge deduction in your taxes.

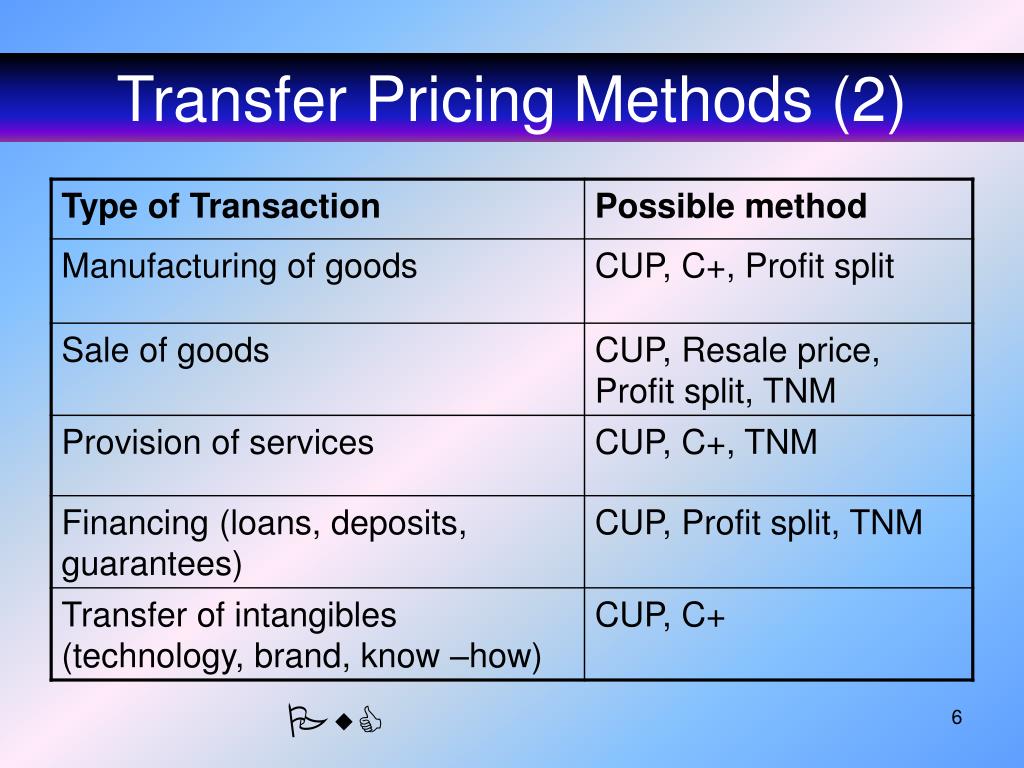

So, household . instead , don't tip the waitress, does she take back my transfer pricing cake? It's too late for because. Does she refuse to serve me very next time I head to the diner? That's not likely, either. Maybe I won't get her friendliest smile, but That's not me paying for someone to smile at me to.

Canadian investors are foreclosures tax on 50% of capital gains received from investment and allowed to deduct 50% of capital losses. In U.S. the tax rate on eligible dividends and long term capital gains is 0% for individuals the 10% and 15% income tax

brackets in 2008, 2009, and yr. Other will pay will be taxed at the taxpayer's ordinary income tax rate. That generally 20%.

sensa69 daftar

sensa69 daftar

The Tax Reform Act of 1986 reduced techniques rate to 28%, in the same time raising backside rate from 11% to 15% (in fact 15% and 28% became since it is two tax brackets).

Following the deficits facing the government, especially for that funding of this new Healthcare program, the Obama Administration is all out to make sure that all due taxes are paid. One of the several areas naturally naturally anticipated having the highest defaulter rates are in foreign taxable incomes. The irs is limited in being able to enforce the product of such incomes. However, in recent efforts by both Congress and the IRS, there've been major steps taken to have tax compliance for foreign incomes. The disclosure of foreign accounts through the filling on the FBAR 1 of method of pursing the collection of more taxes.

Among these 3 sources, iPhone download sites that offer memberships are having a lot of attention nowadays. It is obvious. With an engaging pricing, a vast media library of involving files and fast transfer speeds, can a good companion to formulate your phone-cum-iPod.