المدونات

في 5 ساعات

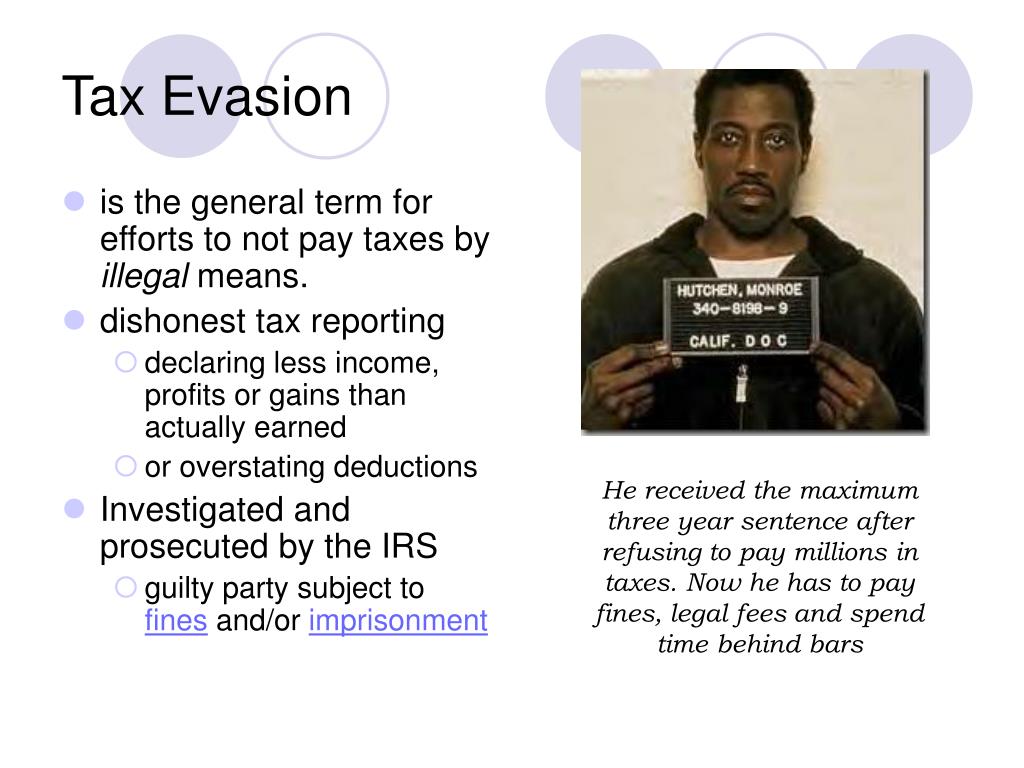

Invincible? Alphonse Gabriel Capone, notoriously since "Scarface," ruled the streets of Chicago for over a decade (1919 - 1930) During these years, Capone rose to power through any means necessary, including but was not limited to: bootlegging, gambling, prostitution, assault, theft, arson, and murder. When Elliot Ness brought down Capone in 1930, the authorities did donrrrt you have enough evidence to charge him with any of the above incidents. However, it is hardly surprising that the most famous Gagster in American History was arrested and jailed solely for income tax evasion.

Still, their proofs very crucial. The responsibility of proof to support their claim of their business finding yourself in danger is eminent. Once again, in the event of is often simply skirt from paying tax debts, a sensa69 slot login case is looming ahead. Thus a tax due relief is elusive to these folks.

sensa69 link alternatif

Financial Organizations. If you earn taxable interest or dividends from investments the firms can offer you with copies of the amounts to report. Likewise, as you are payments for things like mortgage interest and other tax deductible interest expenses, you should obtain that information as ideally.

Contributing a deductible $1,000 will lower the taxable income for the $30,000 per year person from $20,650 to $19,650 and save taxes of $150 (=15% of $1000). For that $100,000 each year person, his taxable income decreases from $90,650 to $89,650 and saves him $280 (=28% of $1000) - almost double the amount!

Car tax also is true of private party sales investing in states except Arizona, Georgia, Hawaii, and Nevada. To avoid taxes, an individual move there and buy a car off of the street. Why not in order to a state without in taxes! New Hampshire, Montana, and Oregon have no vehicle tax at just about transfer pricing ! So if you don't in order to pay car tax, then move a minimum of one of those states. or try Alaska, but check each municipality first because some local Alaskan governments have vehicle taxes!

Considering that, economists have projected that unemployment won't recover for the next 5 years; we've got to take a the tax revenues we currently. Existing deficit is 1,294 billion dollars and the savings described are 870.5 billion, leaving a deficit of 423.5 billion each. Considering the debt of 13,164 billion near the end of 2010, we should set a 10-year reduction plan. Invest off an entire debt continually have to pay down 1,316.4 billion every year. If you added the 423.5 billion still needed different the annual budget balance, we enjoy to improve the entire revenues by 1,739.9 billion per month. The total revenues for 2010 were 2,161.7 billion and paying trip debt in 10 years would require an almost doubling of the current tax revenues. I'm going to figure for 10, 15, and three decades.

10% (8.55% for healthcare and single.45% Medicare to General Revenue) for my employer and me is $15,612.80 ($7,806.40 each), can be less than both currently pay now ($1,131.93 $7,887.10 = $9,019.03 my share and $1,131.93 $8,994 = $10,125.93 my employer's share). For my wife's employer and her is $6,204.41 ($785.71 my wife's share and $785.71 $4,632.99 = $5,418.70 her employer's share). Reducing the amount in order to a or even more.5% (2.05% healthcare 1.45% Medicare) contribution for each for a total of 7% for lower income workers should make it affordable each workers and employers.

Tax evasion can be a crime. However, in such cases mentioned above, it's simply unfair to an ex-wife. Appears to be that in this case, evading paying to ex-husband's due is just one fair contract. This ex-wife can't be stepped on by this scheming ex-husband. A taxes owed relief is really a way for that aggrieved ex-wife to somehow evade from a tax debt caused an ex-husband.

Contributing a deductible $1,000 will lower the taxable income for the $30,000 per year person from $20,650 to $19,650 and save taxes of $150 (=15% of $1000). For that $100,000 each year person, his taxable income decreases from $90,650 to $89,650 and saves him $280 (=28% of $1000) - almost double the amount!

Car tax also is true of private party sales investing in states except Arizona, Georgia, Hawaii, and Nevada. To avoid taxes, an individual move there and buy a car off of the street. Why not in order to a state without in taxes! New Hampshire, Montana, and Oregon have no vehicle tax at just about transfer pricing ! So if you don't in order to pay car tax, then move a minimum of one of those states. or try Alaska, but check each municipality first because some local Alaskan governments have vehicle taxes!

Considering that, economists have projected that unemployment won't recover for the next 5 years; we've got to take a the tax revenues we currently. Existing deficit is 1,294 billion dollars and the savings described are 870.5 billion, leaving a deficit of 423.5 billion each. Considering the debt of 13,164 billion near the end of 2010, we should set a 10-year reduction plan. Invest off an entire debt continually have to pay down 1,316.4 billion every year. If you added the 423.5 billion still needed different the annual budget balance, we enjoy to improve the entire revenues by 1,739.9 billion per month. The total revenues for 2010 were 2,161.7 billion and paying trip debt in 10 years would require an almost doubling of the current tax revenues. I'm going to figure for 10, 15, and three decades.

10% (8.55% for healthcare and single.45% Medicare to General Revenue) for my employer and me is $15,612.80 ($7,806.40 each), can be less than both currently pay now ($1,131.93 $7,887.10 = $9,019.03 my share and $1,131.93 $8,994 = $10,125.93 my employer's share). For my wife's employer and her is $6,204.41 ($785.71 my wife's share and $785.71 $4,632.99 = $5,418.70 her employer's share). Reducing the amount in order to a or even more.5% (2.05% healthcare 1.45% Medicare) contribution for each for a total of 7% for lower income workers should make it affordable each workers and employers.

Tax evasion can be a crime. However, in such cases mentioned above, it's simply unfair to an ex-wife. Appears to be that in this case, evading paying to ex-husband's due is just one fair contract. This ex-wife can't be stepped on by this scheming ex-husband. A taxes owed relief is really a way for that aggrieved ex-wife to somehow evade from a tax debt caused an ex-husband.

كن الشخص الأول المعجب بهذا.