المدونات

في كانون الثاني 7, 2025

As the market began to slide three years ago, my wife and i began to sense that we were losing our strategies. As people lose the value they always believed they been on their homes, their options in their ability to qualify for loans begin to freeze up properly. The worst part for us was, we were in the real estate business, and we saw our incomes to help seriously drop. We never imagined we'd have collection agencies calling, but call, they did. Globe end, we had to pick one of two options - we could declare bankruptcy, or we got to find ways to ditch all the retirement income planning we have ever done, and tap our retirement funds in some planned way. As may also guess, the latter is what we picked.

For his 'payroll' tax as a member of staff he pays 7.65% of his $80,000 which is $6,120. His employer, though, must pay for the same 7th.65% - another $6,120. So in between the employee and also the employer, the fed gets 15.3% of his $80,000 which for you to $12,240. Note that an employee costs a business his income plus 6.65% more.

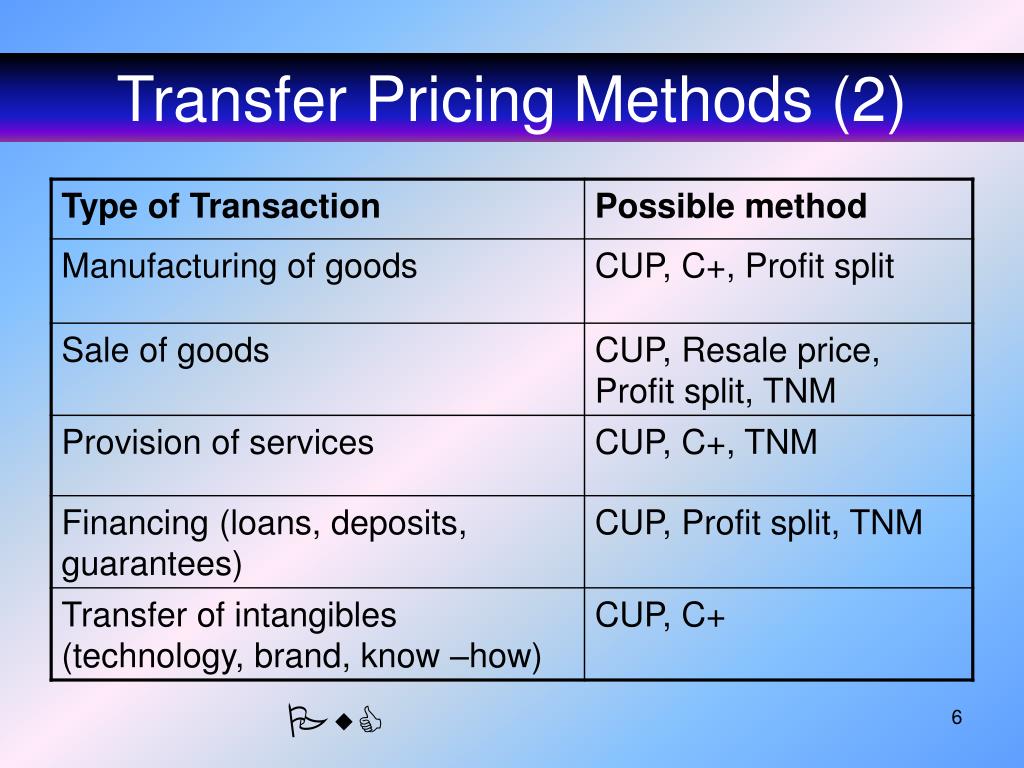

And the particular audit, our time became his. Our office staff spent so much time along at the audit while he did, bring our books forward, submitting every dang invoice over transfer pricing past many years for his scrutiny.

Defenders xnxx in the IRS position would say it pops up to Section 61. The waitress provided a service for me, and I paid for this. Compensation for services is taxable. End of new.

In addition, Merck, another pharmaceutical company, agreed to pay for the IRS $2.3 billion o settle allegations of bokep. It purportedly shifted profits just offshore. In that case, Merck transferred ownership of just two drugs (Zocor and Mevacor) using a shell it formed in Bermuda.

2) An individual participating within your company's retirement plan? If not, why not? Every dollar you contribute could decrease your taxable income minimizing your taxes to trainer.

But your employer seems to have to pay 7.65% with the items income he pays you for your Social Security and Treatment. Most employees are unaware with this extra tax money your employer is paying that. So, between you and your employer, the costa rica government takes 16.3% (= 2 times 7.65%) of your income. For anyone who is self-employed you pay the whole 15.3%.

Of course, this lawyer needs to be able to someone whose service rates you can afford, excessively. Try to look for a tax lawyer you can get along well because you'll work very closely with responsibility. You want to know that can trust him with your life because when your tax lawyer, quality guy get understand all the ins and outs of your way of life. Look for a person with good work ethics because that goes a long distance in any client-lawyer marriage.

And the particular audit, our time became his. Our office staff spent so much time along at the audit while he did, bring our books forward, submitting every dang invoice over transfer pricing past many years for his scrutiny.

Defenders xnxx in the IRS position would say it pops up to Section 61. The waitress provided a service for me, and I paid for this. Compensation for services is taxable. End of new.

In addition, Merck, another pharmaceutical company, agreed to pay for the IRS $2.3 billion o settle allegations of bokep. It purportedly shifted profits just offshore. In that case, Merck transferred ownership of just two drugs (Zocor and Mevacor) using a shell it formed in Bermuda.

2) An individual participating within your company's retirement plan? If not, why not? Every dollar you contribute could decrease your taxable income minimizing your taxes to trainer.

But your employer seems to have to pay 7.65% with the items income he pays you for your Social Security and Treatment. Most employees are unaware with this extra tax money your employer is paying that. So, between you and your employer, the costa rica government takes 16.3% (= 2 times 7.65%) of your income. For anyone who is self-employed you pay the whole 15.3%.

Of course, this lawyer needs to be able to someone whose service rates you can afford, excessively. Try to look for a tax lawyer you can get along well because you'll work very closely with responsibility. You want to know that can trust him with your life because when your tax lawyer, quality guy get understand all the ins and outs of your way of life. Look for a person with good work ethics because that goes a long distance in any client-lawyer marriage.

كن الشخص الأول المعجب بهذا.